The Tug of War Between Urgency and Caution

Kenya’s real estate market—especially in Nairobi—has reached a defining moment. While some potential homebuyers are rushing to secure property before prices escalate further, others are cautiously holding back, waiting for interest rates to ease or for economic clarity. So, should you buy a house in Nairobi now or wait?

This article dives into this dilemma from a Kenyan perspective, offering localized insights into interest rates, housing demand, inflation, and affordability.

The Case for Buying a House in Nairobi Now

1. Land and Construction Costs Are Rising Fast

In Nairobi, the cost of land and building materials has been on a steady upward trajectory. Prices in suburbs like Syokimau, Ruaka, and Joska have surged due to infrastructure projects and demand spillover from the city.

- Example: Between 2021 and 2025, land prices in Kitengela and Juja have increased by up to 25%, while cement and steel prices have spiked due to inflation and import costs.

Buying now allows you to lock in current prices and avoid future cost surges.

2. Property Demand is Growing in Satellite Towns

The Nairobi Metropolitan region continues to experience population growth, fueled by urban migration and expanding middle-class aspirations.

- Areas such as Ngong, Athi River, Kamulu, and Kangundo Road have seen rising interest from both first-time homeowners and real estate investors.

- With demand outpacing supply in many of these areas, waiting too long may push you out of your preferred location or budget range.

3. Kenya’s Inflation Trends Favor Asset Ownership

Inflation in Kenya remains unpredictable. Owning a home protects you against escalating rental costs and currency devaluation. Real estate serves as a hedge against inflation—a stable investment in turbulent times.

Read Also: The Angle of the Sun: How Solar Positioning Affects House Design and Resale Value in Kenya

The Case for Waiting a Little Longer

1. Mortgage Interest Rates Are Still High

While Kenya’s Central Bank Rate (CBR) has begun to stabilize in 2025, average mortgage rates remain between 11–13% depending on the lender. Some potential homeowners hope rates will fall in the next 12–18 months.

If you’re not in a rush, waiting for lower interest rates could save you thousands in long-term repayments.

2. You May Need More Time to Strengthen Your Finances

Banks in Kenya require:

- 10–20% down payment

- Proof of stable income

- Clean record from CRBs

- Legal, valuation, and transfer fees totaling an extra 6–8% of the purchase price

If you’re not yet financially ready, it’s better to wait while saving and preparing your documentation rather than rushing into a mortgage you can’t sustain.

Nairobi-Specific Trends to Watch in 2025

| Trend | Implication for Buyers |

|---|---|

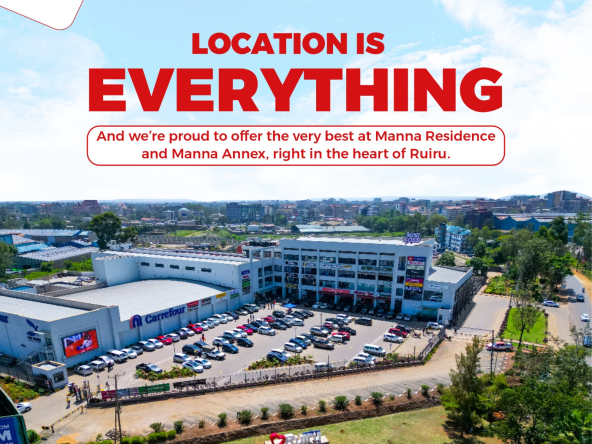

| Affordable housing projects in Ruiru, Mavoko, and Thika | Opportunities for first-time buyers to enter the market |

| Nairobi Expressway & Outer Ring expansions | Boosting land value along their corridors |

| Rise of gated communities in Joska and Kamulu | Safer, structured living options for families |

| Government incentives like Stamp Duty exemptions for first-time buyers | Lower entry barriers for youth and new families |

These trends suggest that buyers who are location-flexible and financially ready can benefit greatly by acting now.

Decision Checklist: Buy Now or Wait?

| Question | If Yes | If No |

|---|---|---|

| Have you saved at least 15% of your target home price? | ✔ Consider buying | ✘ Wait and save |

| Is your income stable and provable? | ✔ You’re ready | ✘ Build income consistency |

| Is your CRB record clean? | ✔ Pre-qualify for loans | ✘ Work on credit repair |

| Are prices in your target area rising steadily? | ✔ Secure before it’s unaffordable | ✘ Monitor trends |

| Can you manage a loan at 12–13% interest? | ✔ Lock in and buy | ✘ Wait for possible rate drop |

Pro Tip: “Date the Rate, Marry the Home”

Even if interest rates are high now, you can refinance when rates drop in future. The home you buy today may be out of reach in a year due to rising prices, but mortgage rates can be renegotiated.

Nairobi’s Market Rewards the Prepared

If you’re financially equipped, understand your neighborhood’s growth potential, and have a long-term view, buying a house in Nairobi now may be the smartest move. Delaying could mean paying more or losing out on your ideal location.

However, if you’re not financially or mentally prepared for homeownership, waiting while building a solid financial base is not a bad strategy. Just remember—Nairobi waits for no one. The city grows, and prices follow.

Read Also: Property Developers in Kenya: Shaping Modern Living Across Nairobi and Beyond

Time Your Move, But Don’t Miss the Train

The Nairobi real estate landscape is dynamic, rewarding those who act with insight and preparation. Whether you buy now or wait, ensure your decision is rooted in local market realities, not fear or guesswork.

Thinking about making the leap?

Talk to a licensed real estate advisor in Nairobi, (preferably Willstone Homes), compare mortgage plans, and scout emerging neighborhoods before the next price surge.