Artificial Intelligence in real estate is no longer an abstract buzzword—it’s actively reshaping how people buy, manage, and invest in property. In Africa, where real estate markets are dynamic but often unpredictable, AI is providing clarity and efficiency that were previously out of reach. From Nairobi to Lagos to Johannesburg, new tools are helping investors make smarter moves, manage risks, and capture opportunities that once slipped through the cracks.

Smarter Market Analysis

One of AI’s biggest strengths lies in its ability to process messy and scattered data. In African real estate, where information is often incomplete or unreliable, this is a game changer. In Kenya, for instance, analytics firms are now combining economic indicators, demographic shifts, and property transaction data to give investors sharper forecasts. Instead of guessing where the market might head, buyers and developers can plan with more confidence.

Read Also: Willstone Homes – When Stone Becomes Immortality, and Real Estate Turns into Empire

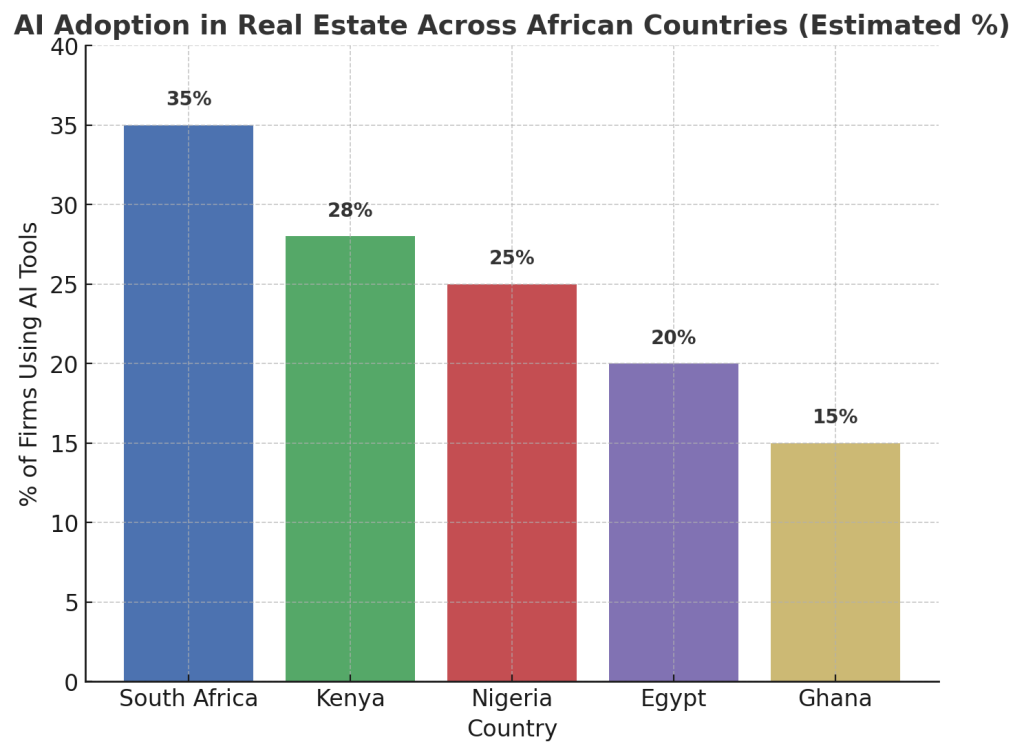

AI Adoption Trends in African Real Estate

AI integration isn’t happening evenly across the continent. Some countries are moving faster than others, depending on the maturity of their tech ecosystems, availability of funding, and government support.

South Africa currently leads in AI adoption for real estate, with a significant share of firms deploying analytics and automation tools. Kenya and Nigeria are quickly catching up, while Ghana and Egypt are showing steady, if slower, progress.

Managing Properties the Intelligent Way

Landlords and property managers are also reaping the benefits. AI-driven platforms are automating routine work like rent collection and tenant vetting, while predictive models flag potential maintenance issues before they spiral into costly repairs. For tenants, this means quicker response times and smoother experiences; for landlords, it translates into lower operating costs and fewer headaches.

Tailored Investment Advice

Every investor has a different appetite for risk, and AI is starting to recognize that. By analyzing an individual’s past decisions alongside broader market data, platforms in Nigeria and beyond are now offering highly personalized recommendations. Rather than generic “hot picks,” investors are getting suggestions that actually match their budgets, risk tolerance, and long-term goals.

Seeing Risks Before They Happen

In markets as diverse and fast-changing as Africa’s, understanding risk is crucial. South African companies are using AI models that assign risk scores to properties by weighing factors like local economic trends, historical pricing patterns, and even neighborhood-level infrastructure challenges. These insights help investors avoid overpaying or getting stuck in volatile markets.

Artificial Intelligence in Real Estate for Faster and Cleaner Transactions

If you’ve ever been involved in a property deal in Africa, you know how drawn-out the paperwork can be. AI, often combined with blockchain, is beginning to streamline this process. Automated document checks, digital verification, and even smart contracts are cutting weeks off deal times while reducing the risk of fraud. That efficiency is making markets more accessible to both local buyers and international investors.

From Design to Smart Cities

The Artificial Intelligence in real estate wave isn’t stopping at transactions. Architects are experimenting with AI-powered design platforms that generate customizable house plans in hours, while governments are leaning on AI to shape the cities of tomorrow. Kenya’s Konza Technopolis is one of the most ambitious examples: a planned “smart city” where AI supports everything from traffic management to sustainable housing. For investors, these projects are magnets, promising growth anchored in data-driven urban planning.

Traditional vs. AI-Driven Investing

| Aspect | Traditional Approach | AI-Driven Approach |

|---|---|---|

| Market Data | Fragmented, slow to update | Real-time, aggregated, predictive |

| Property Management | Manual, reactive | Automated, proactive |

| Investment Recommendations | Generic, one-size-fits-all | Personalized, data-driven |

| Transactions | Bureaucratic, prone to delays and fraud | Streamlined, transparent, secure |

| Risk Assessment | Based on limited, subjective judgment | Holistic, AI-generated risk scoring |

The Bigger Picture

The effects are already visible: faster analysis, more efficient property management, and investment opportunities that would have been overlooked just a few years ago. Smart cities, personalized investment dashboards, and predictive maintenance tools aren’t “future concepts” in Africa—they’re here, and they’re multiplying.

Artificial Intelligence in real estate isn’t replacing human judgment, but it is amplifying it. For a continent in the midst of rapid urban growth, that means investors are better equipped to manage risks, spot trends early, and fuel the next wave of development

Read Also: Townhouse vs. Maisonette Living in Nairobi: Which Housing Style Fits Modern Families Best?