In the ever-evolving landscape of real estate investment in Kenya, a quiet revolution is taking shape — led not by banks or developers, but by tightly knit communities of Kenyans living abroad. Known as Diaspora Housing Saccos, these structured financial cooperatives are redefining how property is bought, built, and owned by Kenyans abroad.

Once driven by informal remittances and word-of-mouth land purchases through relatives, today’s diaspora investors are embracing Saccos as a safer, more accountable route to owning a piece of home. This shift, particularly evident in fast-developing zones around Nairobi, Kiambu, Juja, and Thika, is transforming how the Kenyan middle class in the diaspora engages with the local real estate sector.

From Informal Trust to Formal Structures

For decades, the Kenyan diaspora — especially in the United States, United Kingdom, Canada, and Gulf countries — has sent home billions in remittances. The Central Bank of Kenya reported over $4 billion in diaspora remittances in 2023 alone, with a significant portion earmarked for land acquisition and construction.

But the process has often been plagued by heartbreak. From relatives mismanaging funds to buying non-existent plots, trust-based transactions without institutional safeguards have left many diaspora investors with nothing but dashed hopes. The rise of Diaspora Housing Saccos represents a collective response to that risk.

These cooperatives allow overseas members to pool resources, vet land opportunities through due diligence teams, and invest in real estate under a legally registered body — complete with member shares, project timelines, and return on investment models.

A System Built on Shared Risk and Transparency

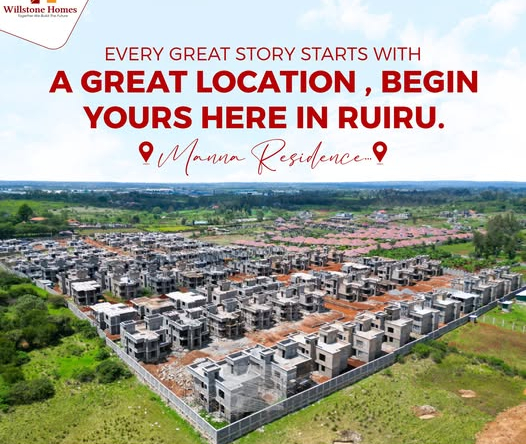

Unlike traditional land buying through individuals or agents, housing Saccos for diaspora members are built on principles of cooperative ownership and mutual accountability. Every member typically contributes a fixed amount monthly or quarterly. The Sacco then identifies strategic land in growth areas like Juja, Ruiru, and Thika, often close to new roads, infrastructure, or planned economic hubs.

These projects range from serviced plots to full-scale estate developments, depending on the Sacco’s ambition and membership capital. Members receive regular updates, audited reports, and even livestreams or video documentation of site visits and construction phases.

“We wanted a way to build without fear,” says Annette Wanjiku, a Kenyan nurse based in Maryland and founding member of a diaspora housing Sacco. “Sending money to family members didn’t work. Now, I know where every shilling goes, and I own a share of land with a title under my name.”

Real Estate by the People, for the People

One of the defining aspects of diaspora housing Saccos is that they bypass the profit-hungry developer model. By pooling resources, members can purchase land and develop it at cost, without the markups that individual buyers face when purchasing units from commercial developers. This model results in more affordable homes, often of higher quality, because the end users are also the stakeholders.

Many Saccos focus on build-to-own schemes, where members progressively contribute towards construction after the land is acquired. Others adopt a build-to-rent model, where members own rental units that are managed by the Sacco to generate income.

The success of this model lies in democratizing real estate investment. Diaspora members who might not have had the funds to build individually now find themselves co-owners of significant developments — from gated communities in Kenyatta Road area to apartment blocks in Thika town.

Nairobi’s Satellite Towns: The New Diaspora Frontier

Nairobi’s outskirts — particularly Kiambu, Juja, Ruiru, and Thika — are becoming the primary real estate targets for diaspora Saccos. The reasons are clear: affordable land, infrastructure upgrades, and high rental demand.

For example, the expansion of the Thika Superhighway and upcoming interchanges in the Eastern Bypass corridor have opened up formerly underutilized zones. Plots in areas like Mangu or Gatundu Road — once rural and overlooked — are now being bought by diaspora-led cooperatives in bulk, subdivided, and developed.

As the demand grows, developers and agents are starting to adapt. Some have begun offering diaspora-specific products, such as digitally accessible legal paperwork, remote project supervision, and even cross-border Sacco collaborations between Kenya and host countries abroad.

Read Also: A Landmark Moment: Willstone Homes Delivers Yet Again with Title Issuance for Brookview Estates

Legal Protections and Policy Implications

The Kenyan government has taken note of the growing influence of the diaspora on the housing sector. In 2022, the Ministry of Lands and Physical Planning included diaspora housing groups in discussions on secure digital titling and land verification platforms like ArdhiSasa.

Legal experts advise that diaspora members choose only registered Saccos regulated by the Sacco Societies Regulatory Authority (SASRA) to ensure protection under Kenyan cooperative law. This provides recourse in cases of mismanagement, as well as assurance that project finances are handled transparently.

However, challenges remain. Regulatory lag, land fraud in peri-urban zones, and coordination issues between diaspora-based leadership and on-the-ground teams in Kenya can create friction. Nonetheless, housing Saccos offer significantly more security than informal buying via proxies.

The Road Ahead: From Shelter to Nation-Building

Diaspora housing Saccos are not just about shelter; they represent a new architecture of trust, collaboration, and nation-building. By organizing, documenting, and investing together, Kenyans abroad are contributing more than remittances — they are co-architects of urban growth in Nairobi’s metropolitan belt.

The model is also influencing local investment culture. Young professionals in Kenya are increasingly joining similar urban-based housing cooperatives, inspired by the diaspora’s approach to low-risk, high-impact real estate ownership.

With the Kenyan real estate market set to remain dynamic, diaspora-led cooperative housing stands out as a symbol of what’s possible when innovation meets accountability — offering a blueprint for others seeking to own land not just individually, but collectively, with trust and structure.

The emergence of Diaspora Housing Saccos marks a turning point in how Kenyans abroad engage with their homeland’s property market. By shifting from informal remittance models to cooperative, regulated investment structures, these groups are reducing fraud, amplifying buying power, and creating tangible, long-lasting value. For Nairobi’s surrounding towns — from Juja to Kiambu — the results are already visible in changing skylines and empowered communities.

If you’re a diaspora investor seeking structured entry into Kenya’s land market, consider what these housing cooperatives offer: shared risk, verified land, and collective reward.

Read Also: The Rise of Blockchain in Real Estate: Transforming an Age-Old Industry