In Nairobi’s fast-moving property market, few housing categories have outperformed as consistently as exclusive gated communities. Once considered the preserve of the wealthy, these estates have now become a mainstream choice for middle- and upper-income families seeking security, convenience, and community. But beyond lifestyle appeal, they are proving to be superior investment vehicles. Their ability to deliver higher rental yields, stronger appreciation, and better resale value explains why investors increasingly see them as the safest bet in Nairobi’s real estate market.

Rental Demand and Yields from Exclusive Gated Communities in Nairobi

Rental demand is the lifeblood of property investment, and exclusive gated estates excel in this area. Professionals, expatriates, and upwardly mobile families are willing to pay a premium for secure environments with modern amenities.

According to the HassConsult Property Index (2024), rental yields in gated communities average 6–8% annually, compared to 4–5% for standalone suburban homes. Occupancy rates in prime gated locations like Kiambu Road and Syokimau hover between 85–95%, while standalone homes in less structured neighborhoods average 65–75%.

This demand premium is tied directly to features exclusive estates offer:

- Round-the-clock security and controlled access.

- Shared recreational spaces such as clubhouses, gyms, and children’s parks.

- Proximity to international schools, hospitals, and shopping hubs.

For landlords, this translates into faster tenant turnover, shorter vacancy periods, and a steadier rental income stream.

Price Appreciation and Resale Value

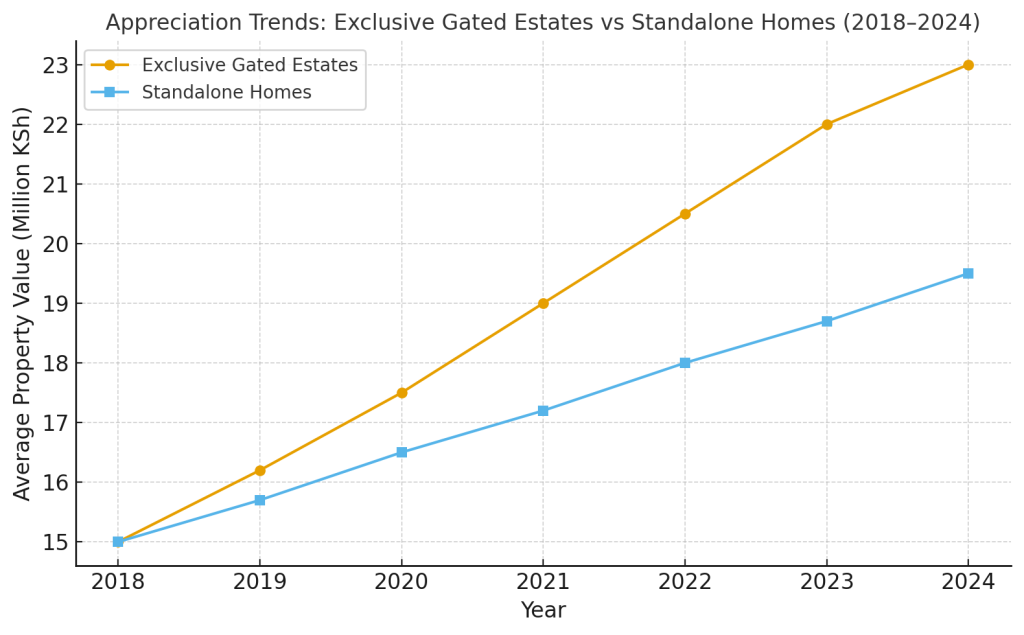

Data from the Kenya Bankers Association Housing Price Index shows homes in gated estates appreciating at 8–12% annually, compared to 5–7% for non-gated properties. The market consistently rewards estates because they combine controlled environments with quality infrastructure — factors that buyers trust.

For example, a maisonette bought in a gated estate along Mombasa Road in 2018 for KSh 15 million now commands upwards of KSh 23 million, a 53% increase in six years. By contrast, many standalone houses in unplanned suburbs have appreciated at a slower pace due to infrastructure gaps and inconsistent neighborhood development.

Resale liquidity is also higher in exclusive estates. Investors looking to offload properties find willing buyers more quickly because gated estates are perceived as safer, well-managed, and more predictable investments.

Lifestyle Demand as an Investment Cushion

The success of gated estates is not only about numbers but also about lifestyle shifts. Nairobi families are increasingly drawn to the social fabric that gated estates provide:

- Children can play safely outdoors without fear of traffic or crime.

- Residents’ associations create accountability, organize events, and maintain standards.

- Cleaner, greener environments give estates an edge over unregulated urban sprawl.

This lifestyle appeal creates a cushion for investors. Even during economic slowdowns, tenants prioritize secure and organized living, which protects gated estates from dramatic rental or price drops.

Performance Comparison

Exclusive Gated Estates vs. Standalone Homes in Nairobi

| Metric | Exclusive Gated Estates | Standalone Homes |

|---|---|---|

| Rental Yields | 6–8% annually | 4–5% annually |

| Occupancy Rates | 85–95% (prime locations) | 65–75% |

| Annual Price Appreciation | 8–12% | 5–7% |

| Resale Liquidity | High – faster transactions | Moderate – slower demand |

| Infrastructure & Amenities | Planned roads, security, shared facilities | Often self-managed, uneven quality |

| Tenant/Buyer Profile | Middle-class families, professionals, expatriates | Mixed, mostly local buyers |

Willstone Homes: Setting the Benchmark

Among developers, Willstone Homes has been at the forefront of delivering exclusive gated communities that balance modern design, reliable infrastructure, and secure environments. Their estates are not only places to live but also assets that outperform the market consistently. For families, Willstone Homes offers comfort and community. For investors, they provide liquidity, steady yields, and long-term appreciation

The evidence is clear: exclusive gated communities in Nairobi outperform because they deliver both lifestyle and returns. With rental yields averaging 6–8%, appreciation rates of 8–12% annually, and higher resale liquidity, they stand out as one of the most resilient real estate investments in Kenya’s capital. Developers like Willstone Homes continue to prove that gated estates are not just a housing trend but the future of secure, profitable urban living.

Read Also: How Trust (or Lack of It) Shapes Off-Plan Community Sales