Kenya’s affordable housing agenda has received a major boost following the conclusion of the 41st African Union for Housing Finance (AUHF) Conference, held at Nairobi’s Radisson Blu Hotel, Upper Hill from October 13–16, 2025.

Under the theme “Blended Finance for Affordable Housing: Making the Numbers Work,” the gathering brought together policymakers, financiers, and developers to discuss new ways to unlock private capital for housing across Africa.

Now that the four-day summit has ended, the question for Kenya’s market is simple: what happens next?

As post-conference analysis shows, the conversations in Nairobi could reshape how homes are financed, built, and delivered — not just in the capital, but across the country’s fast-growing satellite towns.

Read Also: Friday Flow at Willstone Homes: Where Hustle Meets Heart, and the Weekend Begins with a Win

Blended Finance Takes Center Stage

Blended finance — the strategic use of public or philanthropic funds to de-risk private investment — dominated nearly every discussion.

Conference hosts, including Kenya Mortgage Refinance Company (KMRC), Shelter Afrique Development Bank, FSD Kenya, and iBuild Global, emphasized that the housing gap cannot be closed through public funding alone.

“Affordable housing must move from a government programme to a full-fledged investment class,” said one panelist from Shelter Afrique. “Blended finance gives investors confidence to participate in projects that are socially vital but commercially complex.”

This approach could be a turning point for developers. By combining concessional capital with market-rate loans, it becomes easier to fund large-scale projects without over-leveraging. For firms like Willstone Homes, which operate in emerging residential zones, such frameworks offer a new route to growth and sustainability.

‘The Blender’ — Turning Proposals into Real Projects

A key highlight was “The Blender”, an investment-pitch session where project developers presented real transactions to a panel of lenders, DFIs, and impact investors.

Several Kenyan proposals reportedly drew strong interest — particularly those using modular construction, green design, or rent-to-own financing.

Early indications from AUHF’s follow-up briefings suggest that at least three deals advanced to term-sheet discussions, including one mid-income estate along Kangundo Road and another rental-conversion project in Kisumu.

While final investment decisions will take months, the symbolism is clear: affordable housing has entered the deal-making phase.

Read Also: How the Land Amendment Act Kenya 2025 Is Reshaping Land Buying in Nairobi and Its Satellite Towns

Opportunities for Developers and Financiers

The conference clarified that Kenya’s affordable housing challenge is not a lack of ideas but a lack of bankable structures.

By blending capital from multiple sources — development partners, pension funds, and commercial lenders — developers can better manage interest rates and construction risks.

Key opportunities include:

- Structured partnerships: Local builders can partner with fund managers or SACCOs to co-develop estates under blended-finance terms.

- Green and digital incentives: Projects that meet energy-efficiency or smart-infrastructure criteria are more likely to attract international capital.

- Pipeline development: Agencies like KMRC plan to issue new refinancing products targeting projects aligned with AUHF’s recommendations, potentially reducing mortgage rates for end-buyers.

Lessons from Across Africa

Case studies presented at AUHF 2025 showcased successful blended-finance applications:

- Nigeria’s Family Homes Fund used a combination of sovereign guarantees and impact-investor capital to deliver over 12,000 low-cost homes.

- South Africa’s TUHF demonstrated how targeted risk-sharing with the government made inner-city rental conversions viable.

- Rwanda shared insights on integrating housing finance with digital property-registration systems to reduce transaction risk.

These experiences offer blueprints for Kenya’s evolving market. The takeaway is that when the state provides stability and private players bring efficiency, housing affordability improves without compromising quality.

What It Means for Kenya’s Housing Pipeline

Kenya’s national target of delivering one million housing units by 2027 now looks more achievable — but only if private developers can access blended finance at scale.

With the country’s construction sector projected to grow 7.5% annually and the market valued at KSh 2.6 trillion, the timing couldn’t be better.

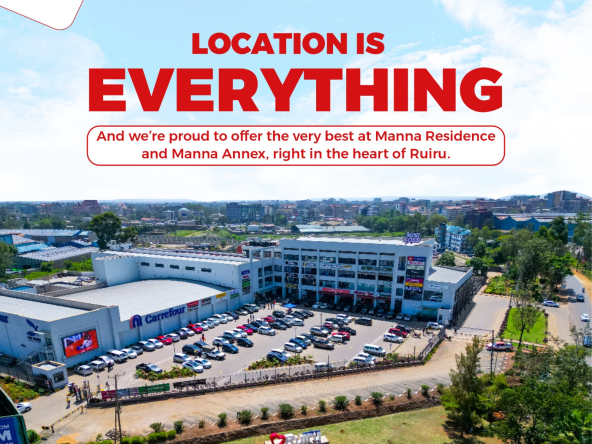

Affordable housing estates in Kiambu, Juja, Kamulu, Ruiru, and Athi River are already attracting attention from financiers looking for proof-of-concept projects.

For property developers in Kenya, this means aligning with sustainability standards, modular efficiency, and financial transparency — the three traits funders highlighted repeatedly in Nairobi.

From Policy to Practical Impact

One recurring theme at the conference was data and risk pricing. Investors need credible information on construction costs, buyer demand, and repayment patterns.

To fill this gap, the Centre for Affordable Housing Finance in Africa (CAHF) announced plans to expand its Kenya Housing Data Dashboard, offering more granular metrics for project feasibility.

Meanwhile, FSD Kenya committed to support a pilot for alternative credit scoring — allowing tenants with consistent rent-payment histories to qualify for mortgages.

These initiatives could democratize access to housing finance and expand the buyer base for developers.

A New Frontier for Small and Mid-Size Builders

Perhaps the most practical message from AUHF 2025 was that smaller developers matter.

While mega-projects often grab headlines, it is mid-tier builders who deliver the bulk of affordable units.

With proper due diligence and transparent costings, these players can now tap blended-finance opportunities previously reserved for large corporations.

This aligns with the government’s Affordable Housing Program (AHP), which increasingly relies on private-sector execution. Through county-level PPPs and site-service models, smaller builders can access land and infrastructure while financiers cover part of the construction cost.

Read Also: Where Foundations Meet Legacy: Building Tomorrow’s Homes in the Shadow of a Nation’s Giant

What to Watch After AUHF 2025

- Funding Announcements: Track which “Blender” projects close successfully — they will set the benchmark for structuring future deals.

- New Financial Products: Expect KMRC, Shelter Afrique, and private lenders to roll out blended-finance mortgage options before mid-2026.

- Policy Updates: The State Department for Housing is drafting guidelines on risk-sharing and blended-finance eligibility.

- Regional Expansion: Other East African nations are considering joint housing-finance frameworks following Nairobi’s success — positioning Kenya as a continental hub.

The 41st AUHF Conference may have ended, but its ripple effects are just beginning.

By turning dialogue into deal flow, it has positioned Kenya’s affordable housing sector for a decade of renewed growth — powered by blended finance, smarter construction, and inclusive home-ownership models.

For property developers in Kenya, financiers, and buyers, the message is clear: the tools are finally on the table. It’s time to build.