Property ownership continues to play a central role in building long-term stability, wealth continuity, and emotional security for families. In a rapidly expanding urban environment like Nairobi and its surrounding growth corridors, owning a home represents more than an asset — it is a foundation for identity, belonging, and future prosperity. For many households pursuing intentional financial planning, investing in home ownership in Kenya becomes a meaningful way to secure stability for both present and future generations.

Across urban residential markets, particularly within developing and lifestyle-driven neighborhoods, families are increasingly prioritizing homeownership in Nairobi Kenya as part of structured economic decision-making. Rather than approaching housing as a temporary consumption expense, more buyers now view buying a home in Nairobi as a strategic pathway toward resilience, generational continuity, and sustainable family security.

Read Also: How Social Media & TikTok Are Influencing Property Purchase Decisions in Nairobi

The Long-Term Security Value of Homeownership

Property remains one of the strongest asset-backed financial safeguards. Market activity in recent years shows steady interest in real estate investment in Kenya, especially in Nairobi satellite towns where infrastructure expansion continues to unlock new residential zones. While price movements vary across locations, property tends to offer more predictable long-term value compared to short-duration speculative investments.

Families pursuing family property investment Nairobi benefit from reduced rent exposure, improved budgeting confidence, and future-ready wealth preservation options. A home also acts as a financial anchor that can support medium- to long-term financial planning goals.

Research insights from housing sector trend analyses indicate that residential properties in infrastructure-linked corridors and upcoming commuter estates have demonstrated stronger resilience and appreciation potential. These indicators continue to encourage structured, steady property acquisition among working families who are seeking to secure your family’s future with property through assets that grow in relevance over time.

Key ways property ownership strengthens family security include:

- Long-term capital preservation that converts income into an appreciating asset, supporting legacy building through property ownership for the next generation.

- The ability to leverage property for financing, business expansion, or structured investment diversification, reinforcing predictable long-horizon financial stability.

Property Ownership as a Legacy Asset for Future Generations

A home remains one of the most meaningful inheritance assets a family can pass down. Unlike movable possessions, a permanent residence provides continuity — emotional, social, and generational. For many Kenyan households, property represents progress, dignity, and foresight. It strengthens identity by ensuring that children and dependents grow up with grounding, stability, and a permanent place to belong.

The rise in inter-generational wealth planning has encouraged more families to acquire properties not only for present use, but also for structured transfer to dependents. Gifting or allocating a home as part of a succession plan supports stability and safeguards family wellbeing over time. As more households embrace asset-based continuity strategies, houses for sale in Nairobi Kenya have become increasingly attractive for buyers seeking both personal residence and legacy-aligned value.

Table: How Property Ownership Protects and Benefits Families

| Factor | Renting | Property Ownership |

|---|---|---|

| Long-term financial value | Payments do not build equity | Payments contribute to a permanent appreciating asset |

| Family security | Dependent on tenancy continuity | Assured long-term place of residence |

| Wealth transfer potential | No inheritance continuity | Structured inter-generational transfer |

| Emotional connection | Short-term living arrangement | Permanent identity and belonging |

| Financial planning | Limited predictability | Supports asset-based planning and future security |

This contrast explains why more families continue to direct savings toward affordable homes in Nairobi 2026, where ownership delivers both lifestyle value and durable financial impact.

Emotional and Social Rewards of Gifting Property

Beyond measurable financial returns, a home carries profound emotional value. Gifting property communicates protection, care, and long-term commitment. For parents, it ensures retirement dignity and independence. For children or young families, it provides a foundation that minimizes future strain and encourages responsible financial start-up.

A gifted home matures in meaning over time. It becomes a shared family symbol — a reminder of sacrifice, growth, and collective resilience. Whether transferred during major life milestones or allocated as part of future succession planning, property gifting strengthens unity and reinforces shared identity across generations.

Market Trends Influencing Homeownership Decisions in 2026

The approach toward residential acquisition in Nairobi continues to evolve in response to infrastructure connectivity, demographic shifts, and payment flexibility. Several notable trends are shaping purchase decisions heading into 2026:

- Increasing availability of structured installment models and buyer-supportive acquisition plans has made it easier for households to commit to real estate investment in Kenya earlier in their financial journey.

- Growth in commuter towns and emerging residential belts has created attractive value corridors for family property investment Nairobi, especially among working-class and professional households.

- Diaspora investors are allocating more capital toward residential acquisitions as part of legacy building through property ownership and long-term family security planning.

These dynamics signal that early 2026 offers strong potential for buyers aiming to take advantage of pricing windows, appreciation opportunities, and location-driven growth factors.

How Willstone Homes Enables Secure Homeownership in 2026

Willstone Homes continues to position itself as a trusted, forward-thinking partner for families pursuing sustainable ownership pathways. Through carefully evaluated developments, responsible project selection, and guided advisory support, the company empowers families to transition confidently from aspiration to reality when acquiring Willstone Homes properties Kenya.

The organization emphasizes livability, accessibility, and long-term value alignment — ensuring that each purchase contributes meaningfully to family stability and future legacy. Its approach encourages responsible, planned acquisition of affordable homes in Nairobi 2026, particularly for buyers seeking multi-generational security outcomes.

Why Willstone Homes is a strong homeownership enabler for families in 2026:

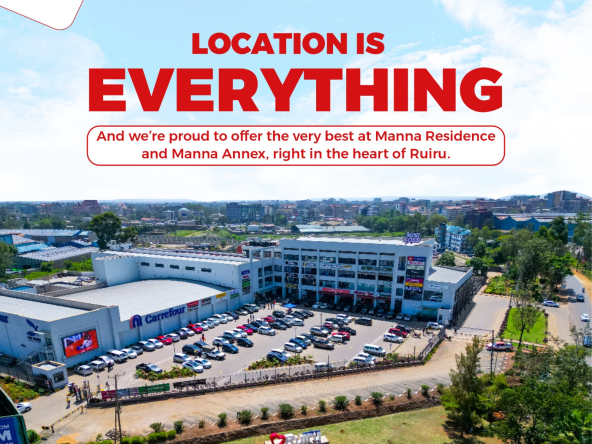

- Projects are strategically located in growth-ready corridors that support appreciation, lifestyle convenience, and legacy-aligned wealth continuity through property ownership in Kenya.

- Client-focused advisory support and flexible acquisition options help families pursue homeownership in Nairobi Kenya with clarity, confidence, and structured long-term financial vision.

Read Also: Top 10 Property Developers in Kenya — How Developers Are Adapting to Flexible Living Spaces

Property ownership remains one of the most enduring and meaningful ways to safeguard a family’s future. From financial resilience to emotional grounding and generational continuity, a home stands at the center of legacy preservation. As urban growth continues to reshape Nairobi’s residential landscape, families seeking to strengthen their future are increasingly embracing buying a home in Nairobi as both a strategic investment and a profound personal milestone.

With a commitment to transparency, value creation, and supportive ownership journeys, Willstone Homes continues to help families secure homes that protect, empower, and inspire lasting legacy — today and for generations ahead.