Nairobi Housing Trends 2025: Nairobi’s housing story is one of contrast. Estates like Buruburu were once models of urban planning — uniform houses, children’s playgrounds, social halls, and green belts. Today, most neighborhoods have descended into disorder, with public spaces swallowed up by parking lots and ad hoc extensions. At the same time, prime suburbs such as Kilimani and Westlands are experiencing a highrise boom, raising new debates about density, infrastructure, and livability. Nairobi stands at a crossroads: between chaotic sprawl in satellite towns and vertical growth in the city’s core.

The Legacy of Planned Estates

Planned estates of the 1970s–1990s were designed to balance affordability and community life. Buruburu, Umoja, Fedha, and Nyayo Estate provided uniform housing, playgrounds, and access to schools and shopping centers. They offered a sense of order, identity, and long-term value.

Timeline of Nairobi’s Planned Estates

| Estate | Year Developed | Planned Features | Current Reality |

|---|---|---|---|

| Buruburu | 1974–1985 | Uniform designs, schools, playgrounds, shopping centers | Mixed designs, playgrounds converted, congestion |

| Umoja | 1978–1990s | Grid layout, social halls, shopping centers | Disorderly extensions, reduced open spaces |

| Nyayo Estate | 1994–1998 | Gated model, uniform houses, internal roads | Still orderly but strained by population |

| Fedha Estate | 1980s–1990s | Planned plots, schools, small parks | Overbuilt, green spaces lost |

These estates, while aging, still hold lessons for Nairobi’s housing future: order and amenities preserve livability and property value.

The Decline into Disorder

By the 1990s, Nairobi’s population boom — from 1.3 million in 1979 to over 5 million today — began outpacing planning capacity. Weak enforcement of zoning rules and corruption allowed homeowners and developers to bypass standards. Playgrounds became private plots, uniform designs gave way to mismatched extensions, and infrastructure strained under unplanned growth.

Satellite towns like Kitengela, Juja, and Ruiru followed the same pattern. Initially marketed as affordable alternatives, they became symbols of uncontrolled sprawl, with poor road networks, unreliable water supply, and limited public spaces.

Read Also: Mang’u 50×100 Land for Sale: Why This Kiambu Opportunity is Gaining Ground

The Highrise Debate in Kilimani and Westlands

While outer neighborhoods sprawled, Nairobi’s core suburbs shifted in another direction: vertical expansion. Kilimani, Westlands, and Kileleshwa have become hotspots for highrise apartments following zoning changes that lifted height restrictions.

Pros

- Increased housing supply in land-constrained areas.

- Better land use efficiency.

- Strong demand from young professionals, corporates, and expats.

Cons

- Overstretched infrastructure: traffic, sewerage, and water shortages.

- Loss of community character and green spaces.

- Rising property prices that risk pricing out middle-income earners.

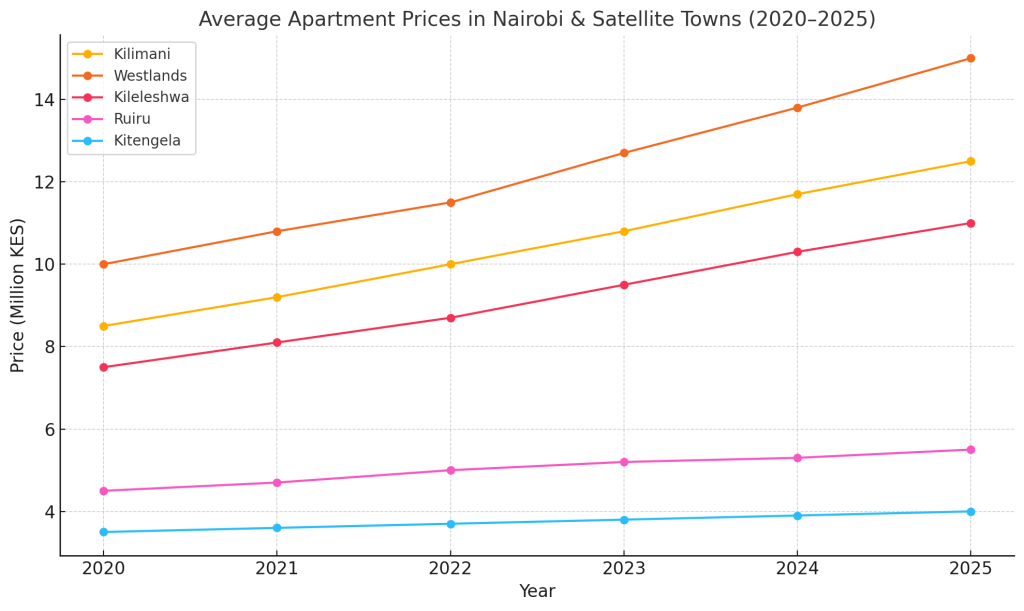

Data Snapshot: Apartment Prices and Yields (2020–2025)

| Area | 2020 Avg Price (KES) | 2025 Avg Price (KES) | Avg Rent Yield (2025) |

| Kilimani | 8.5M | 12.5M | 6.5% |

| Westlands | 10M | 15M | 6.8% |

| Kileleshwa | 7.5M | 11M | 6.2% |

| Ruiru | 4.5M | 5.5M | 5.0% |

| Kitengela | 3.5M | 4M | 4.7% |

A line graph showing the steady price rise in Kilimani, Westlands, and Kileleshwa compared to flatter growth in satellite towns.

Satellite Towns vs Nairobi Suburbs: Diverging Trends

The HassConsult Property Index and Knight Frank reports highlight a widening gap between Nairobi’s suburbs and satellite towns:

| Area | Land Price Change (5 years) | Avg. Apartment Price 2025 (KES) | Notes |

| Kitengela | ↓ 5–10% | 3.5M – 6M | Oversupply, poor infrastructure |

| Ruiru | Flat | 4M – 7M | Congestion, student housing demand |

| Athi River | ↓ 3–7% | 3M – 5.5M | Affordable but weak demand |

| Kilimani | ↑ 12–15% | 10M – 25M | Highrise boom, luxury demand |

| Westlands | ↑ 10–12% | 12M – 30M | Expat & corporate demand |

| Kileleshwa | ↑ 8–10% | 8M – 20M | Densification after zoning changes |

Chart Idea: A bar chart comparing land price growth — suburbs rising vs satellite towns flattening.

Social and Economic Impacts

- Loss of Playgrounds: Children in older estates now play on streets or parking lots, raising safety and social concerns.

- Property Value Risks: Disordered neighborhoods risk stagnation, while well-planned or controlled developments appreciate.

- Shift to Gated Communities: Developments like Tatu City, Tilisi, and Two Rivers are attracting demand for security, uniformity, and amenities.

Read Also: Smart Investors are Choosing Juja’s 50×100 Land for Sale—Here’s the Data Behind the Trend

The Future of Nairobi Housing

Nairobi’s housing market faces two paths:

- Unregulated Sprawl: Continued loss of order, weak infrastructure, and reduced livability.

- Planned Densification: Controlled developments, smart zoning, and community amenities.

Government’s Affordable Housing program aims to merge density with planning, but success will depend on consistent enforcement and community participation

From Buruburu’s playgrounds to Kilimani’s highrises, Nairobi’s housing story reveals the cost of abandoning planning — and the promise of smarter densification. Nairobi real estate trends 2025 point to a decisive moment: embrace order, balance affordability with livability, and ensure that the next generation grows up in neighborhoods that are safe, functional, and valuable.