Real estate investors and developers in The Nairobi property market are increasingly cautious about launching new projects as Kenya election uncertainty builds ahead of the 2027 general polls, according to the latest Knight Frank Kenya market report.

The renowned property consultancy firm says the Kenyan real estate sector has shifted from expansion to consolidation, with most capital now directed toward completing current developments rather than starting new builds.

This trend reflects how political risk in Kenya is shaping property investment decisions in key segments such as residential real estate, commercial offices, retail space and mixed‑use developments.

Read Also: What Smart Property Investors Are Doing Differently in the Bold Nairobi Real Estate Market 2026

Slow Growth in New Property Approvals in Nairobi

Data from Knight Frank’s 2025 review highlights a clear divide between ongoing construction activity and the launch of new projects:

- Cement consumption in Kenya grew by 21% year‑on‑year in the first 11 months of 2025 — showing strong work on existing sites.

- Meanwhile, the value of approved building plans in Nairobi City County dropped by about 24%, with residential approvals falling about 27% during the same period.

According to Charles Macharia, Knight Frank Kenya’s senior research analyst, “While macroeconomic stability improved in late 2025 with lower interest rates and a steadier shilling, the sharp decline in building approvals signals a real estate market focused on consolidation rather than expansion.”

Market Strategy: “Wait and See” Over New Launches

Despite some positive economic signals, real estate investors in Nairobi are taking a cautious, wait‑and‑see stance. Concerns over potential election‑related disruption, fiscal pressures and global volatility are curbing appetite for speculative developments.

The result: the Nairobi property market is concentrating on absorbing existing supply rather than introducing new stock.

Key trends highlighted in the report include:

Residential Real Estate

- Price and rental growth eased in 2025.

- Developers are focusing on completing current projects and prioritizing master‑planned communities, luxury apartments and high‑quality units — especially those attractive to diaspora buyers and high‑net‑worth individuals.

Read Also: Commercial real estate in Nairobi: NSSF to build East Africa’s tallest building in the CBD

Office Property Market

- Prime office occupancy in Nairobi climbed above 81% by December 2025 as tenants seek Grade A, well‑located spaces.

- Major new office developments are now expected to deliver after 2027, reflecting developers’ preference to avoid election year uncertainties.

Retail Real Estate

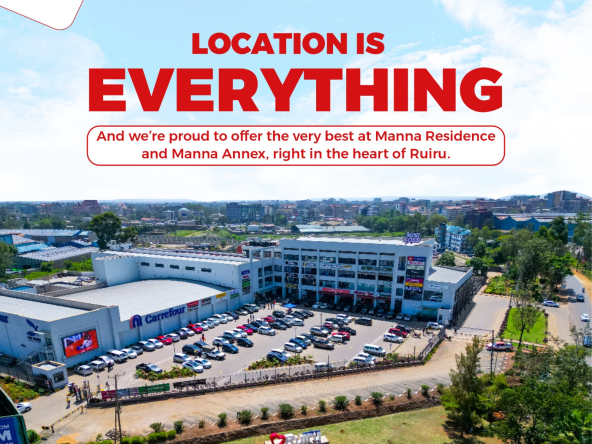

- Growth continues mainly in neighbourhood centres and supermarket‑anchored developments, rather than large regional malls.

- Caution remains high due to past oversupply and reduced consumer spending power.

Outlook for 2026

Knight Frank predicts 2026 will center on disciplined execution, strategic positioning and quality fundamentals rather than aggressive expansion across Kenya’s property market.

Mark Dunford, CEO of Knight Frank Kenya, said:

“Markets centred on quality, sustainability and proven demand fundamentals will thrive, while speculative growth will pause.”

📌 Bright Spots in Kenya Property Investment

Despite the broader slowdown, several areas are expected to perform well:

- Affordable housing – driven by sustained demand and policy support.

- Industrial real estate and logistics – particularly within Special Economic Zones (SEZs).

- Data centres and alternative property assets – attracting institutional capital and long‑term investors.