Nairobi’s skyline is changing fast. In Parklands, Upper Hill, and Kilimani, luxury towers rise with rooftop pools, marble finishes, biometric access, and gyms that rival private clubs. These projects are marketed to high-net-worth buyers, expatriates, and corporates — but their impact goes far beyond the luxury bracket.

Luxury real estate in Nairobi is setting new benchmarks for design, amenities, and pricing. As these expectations spill over into the mid-market, developers, buyers, and even renters are feeling the ripple effect: higher standards, but also higher costs.

The Luxury Anchor: Parklands, Upper Hill & Kilimani

Three Nairobi suburbs highlight this trend:

| Area | Luxury Developments (2020–2025) | Signature Features | Avg. Price Range (KES) |

|---|---|---|---|

| Parklands | High-rise apartments & serviced residences | Rooftop pools, biometric security, smart homes | 20M – 45M |

| Upper Hill | Grade-A office towers + luxury condos | Glass towers, gyms, conferencing facilities | 25M – 60M |

| Kilimani | High-end mixed-use apartments | Concierge services, gyms, high-end finishes | 18M – 40M |

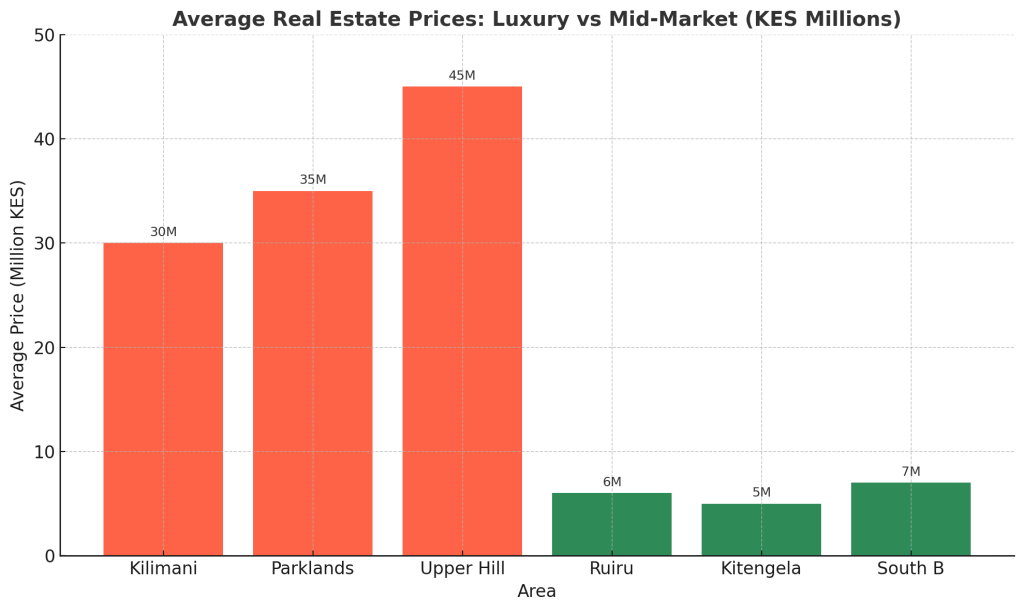

A bar chart comparing average unit prices in these suburbs vs Nairobi’s mid-market (e.g., Ruiru, Kitengela).

The Ripple Effect: How Luxury Raises the Bar

- Amenities Become Standard

- Mid-market buyers now expect gyms, backup generators, water boreholes, and security features — amenities once reserved for high-end units.

- Developers in Ruiru and Kitengela are upgrading specs to remain competitive.

- Design & Finishes

- Luxury apartments showcase imported fittings, smart lighting, and open-plan kitchens. Mid-market developers feel pressure to adopt similar (though cheaper) alternatives.

- Pricing Pressure

- Rising land values in Kilimani and Upper Hill spill into neighboring areas. Buyers who can’t afford prime zones shift to Westlands fringe, Kileleshwa, or South B, raising demand — and prices — there too.

Nairobi Real Estate Market 2025: Data Snapshot

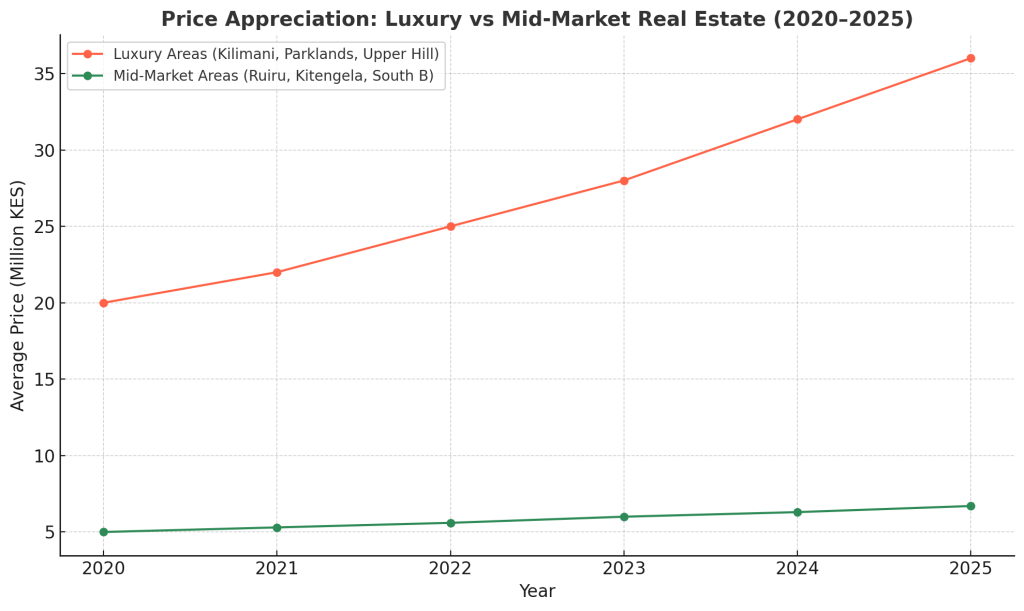

Chart idea: A line graph showing faster price appreciation in luxury zones compared to mid-market zones.

- Average luxury apartment price (Kilimani, Parklands, Upper Hill): KES 20–60M

- Mid-market (South B, Ruiru, Kitengela): KES 4–8M

- Annual growth rate (luxury): 10–12% (2020–2025)

- Annual growth rate (mid-market): 5–7% (2020–2025)

Global Lessons for Nairobi

Cities like Dubai, Johannesburg, and Lagos show the same pattern: luxury projects push up expectations across the board. Nairobi can draw lessons:

- Balance with Affordable Housing: Mandate inclusionary zoning so developers set aside a portion for affordable units.

- Infrastructure-Linked Growth: Luxury zones must help finance roads, sewerage, and transit.

- Market Transparency: Buyers need better valuation data to avoid speculative bubbles.

Read Also: Owning a Home in Nairobi Kenya with Willstone Homes – Together We Build the Future

The Double-Edged Sword

Positive impacts:

- Raises architectural quality and neighborhood prestige.

- Attracts foreign investors, boosting Nairobi’s global real estate profile.

Negative impacts:

- Raises costs for average buyers.

- Contributes to gentrification — pricing out long-term residents in Kilimani and Kileleshwa.

- Increases inequality in housing access.

The rise of luxury real estate in Nairobi is more than a lifestyle statement. It is redefining standards in design, amenities, and pricing — rippling from Parklands and Upper Hill to the city’s mid-market suburbs. While this elevates Nairobi’s global standing, it also risks widening the affordability gap.

The challenge for 2025 and beyond is clear: how can Nairobi sustain its luxury momentum without leaving the average buyer behind? Balancing prestige with inclusivity will define the city’s next chapter in real estate