Ruiru has rapidly transformed from a quiet Kiambu town into one of the most active construction zones in the Nairobi satellite towns real estate market. For many real estate investors in Nairobi, Ruiru is no longer just an alternative to the city—it is now a serious contender among the leading Nairobi property hotspots.

But what is really driving this construction boom, and how does it fit into the wider Nairobi real estate market 2026 outlook?

Here is the real story behind Ruiru’s exploding housing developments.

Ruiru’s rise is tied directly to Nairobi’s shifting housing demand

As congestion, rising prices and limited land continue to affect the city, property investment in Nairobi has increasingly spilled into well-connected commuter zones. Ruiru stands out because it sits right within the fast-growing Thika Road real estate corridor, one of the most strategic transport routes serving northern Nairobi.

This shift reflects broader Nairobi rental market trends, where tenants are prioritising affordability, access to transport and proximity to work hubs over living close to the CBD.

In practical terms, Ruiru is now firmly positioned within the wider commuter towns around Nairobi that attract young professionals, small families and students.

Ruiru has become a major focus for residential developers

One of the strongest drivers of growth is demand for residential property investment Nairobi buyers who want modern housing but at lower entry prices.

Developers are actively rolling out:

- gated communities

- apartment blocks

- maisonette estates

- mixed-use housing projects

This explains the surge in off-plan apartments in Ruiru, which appeal to buyers seeking flexible payment plans and early entry into fast-appreciating locations.

Within the broader Kiambu County real estate market, Ruiru now ranks among the most active development zones.

Affordability is the real attraction

While some Nairobi neighbourhoods are dominated by premium developments, Ruiru’s strength lies in affordable and mid-range housing.

For buyers priced out of Kilimani, Westlands and Parklands, Ruiru offers a practical alternative that aligns closely with the government’s push for affordable housing in Nairobi and its surrounding metropolitan zones.

This affordability is one of the main reasons Ruiru continues to outperform many older estates when it comes to buyer interest and off-plan reservations.

Ruiru fits perfectly into the 2026 market cycle

Looking ahead, Ruiru’s growth reflects broader patterns shaping the Nairobi real estate market 2026. Investors are no longer chasing only prestige addresses. Instead, they are prioritising:

- stable rental demand

- realistic pricing

- transport connectivity

- long-term population growth

As a result, Ruiru real estate investment is now viewed as a strategic long-term play rather than a speculative one.

This also ties into the broader discussion around property prices in Nairobi 2026, where high-end zones are experiencing slower uptake compared to well-priced satellite markets.

Read Also: What Smart Property Investors Are Doing Differently in the Bold Nairobi Real Estate Market 2026

Land continues to drive early-stage investors into Ruiru

Another major contributor to the development boom is the continued demand for land for sale in Ruiru.

Many buyers prefer purchasing plots first and developing gradually, especially local investors and members of the diaspora looking for flexible entry points into the market.

Compared to inner-city estates, Ruiru still offers:

- relatively larger plot sizes

- easier access to greenfield land

- better potential for phased development

This explains why Ruiru consistently attracts both small developers and institutional players operating within the wider property investment in Nairobi ecosystem.

Rental demand is supporting long-term viability

Unlike speculative towns that struggle to attract tenants, Ruiru benefits directly from strong Nairobi rental market trends.

The area draws tenants who work in:

- Nairobi’s industrial zones

- universities and colleges along Thika Road

- nearby business parks

- retail and logistics hubs

This steady tenant flow is what reassures many real estate investors in Nairobi that Ruiru developments are not just selling fast—but also filling up after completion.

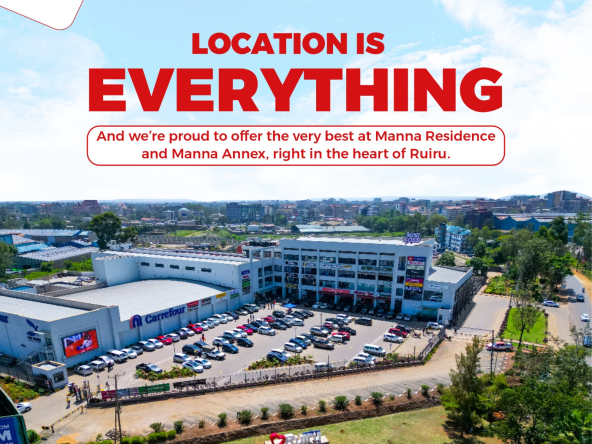

Ruiru’s location advantage remains unmatched

Ruiru’s strategic position along Thika Road makes it one of the most accessible towns within the Nairobi satellite towns real estate network.

Travel time into key parts of the city, including Kasarani, Roysambu and parts of the CBD, remains manageable compared to more distant commuter zones.

This consistent accessibility is one of the reasons Ruiru competes strongly with other Nairobi property hotspots such as Syokimau, Kitengela and Athi River.

Read Also: Commercial real estate in Nairobi: NSSF to build East Africa’s tallest building in the CBD

The real story: Ruiru is no longer a spill-over town

The most important shift is perception.

Ruiru is no longer simply absorbing overflow demand from Nairobi. It is now developing its own commercial centres, education hubs and residential clusters that support a self-sustaining urban ecosystem within the wider Kiambu County real estate market.

This transformation is why developers continue to launch projects despite market uncertainty in other parts of the city.

The real story behind Ruiru’s exploding housing developments is simple: the town has become a central pillar of the Nairobi real estate market 2026.

Strong connectivity along the Thika Road real estate corridor, rising demand for residential property investment Nairobi, growing interest in off-plan apartments in Ruiru, and sustained demand for land for sale in Ruiru have positioned the area as one of the most dependable growth zones for real estate investors in Nairobi.

As Nairobi continues to expand outward, Ruiru is no longer waiting for growth—it is actively shaping the future of Nairobi satellite towns real estate.